Bubblebot

Bubblebot provides a wide range of services in a single Telegram bot, such as spot trading, futures trading, multi-token staking, and hedging/risk management for several crypto assets. This all-in-one platform aims to offer cryptocurrency enthusiasts and traders a useful and flexible experience.

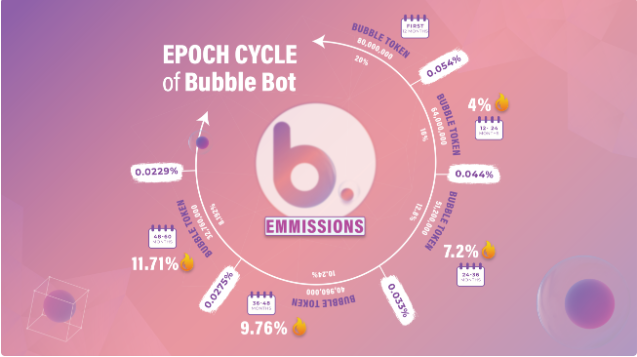

The thrilling opportunity to take part in a variety of activities inside our ecosystem is available to holders of Bubble tokens. This covers trading futures and spot with the option to establish stop losses, giving traders a variety of adaptable and strategic trading options. In addition, holders of Bubble tokens can receive rewards in a number of tokens, including UniBot, PAAL, and numerous meme currencies.

Our major objective is to improve the ecosystem for Telegram bots, encouraging growth and innovation within this vibrant community. We are committed to providing a rich and gratifying experience for our customers so they can explore the variety of opportunities provided by Bubble Token.

Many features of BubbleBot increase your chances of success.

On-chain trading's key issue is that it has a restricted amount of liquidity. Forced liquidations may happen as a result of pricing and financing manipulations due to limited liquidity. Market makers (MMs) consequently don't always have a reason to offer liquidity on the blockchain.

· These contracts allow for long and short trades throughout their duration, offering the same flexibility as conventional futures or perpetual contracts.

Whether you use a controlled exchange (CEX) or a decentralized exchange (DEX), trading cryptocurrencies can be challenging. such as the requirement for collateral, the assessment of risks, interest rates, liquidity, and the unpredictability of laws.

Self-directed trading necessitates proficiency in fundamental and technical analysis, trading strategies, and risk management, as well as the independence to make all trading decisions. Human emotions like fear and greed may have an impact on trading choices.

The unique multi-token staking platform known as Bubblebot is closely related to bot tokens. Anyone in the community has the chance to securely deposit their Bubble tokens into Bubble bot staking pools by taking advantage of the multi-token capability on the Ethereum network. As a result, people may receive incentives in a variety of bot token currencies, such as ETH, UniBot, OCD, and AIM Bot. For all BOT token currencies that use a similar strategy, Bubblebot serves as the main staking token. The website gives users the chance to access a variety of stake pools that are tailored to their unique interests and investing goals.

Based on their evaluations of the state of these assets, analysts can adopt a range of positions in their projections and produce passive income. This Bubble-Insurance platform provides a range of financial activities, such as lending, borrowing, hedging, and betting on the general performance of different crypto assets.

It's important for you to assess your trading habits as a Bubblebot community member, determine whether you tend toward riskier or more volatile trading, and pick the strategies that best serve your objectives. This process is simplified in our Hedge/Risk vault using a bubble-catastrophe bond (BCP). The BCP bond is a vital financial instrument that compensates users for carrying out in-depth assessments and assessing the resilience of pegged crypto assets. Users that predict the underlying asset's value correctly are rewarded with BCP. By exchanging ETH for $Bubble tokens, users can also choose to insure themselves against pegged assets.

Users can choose to shield themselves from a limited number of cryptocurrencies at first, including USDC, USDT, and DAI. Nevertheless, it is anticipated that this product will continue to grow.

Think of a situation where a user is worried that the stablecoin USDT would diverge from its market-pegged value. In this situation, they have the option to use some of their ETH as collateral in the Bubble vault. In return, they get Bubble tokens, which will become more valuable if the stablecoin USDT actually deviates from its set price.

Bubble farms have the following qualities: they are extremely safe, practical, and sustainable. The community can invest in these farms with confidence and possibly earn a fantastic APR of up to 9,860% every week. It is crucial to highlight that the smart contracts powering these farms have successfully completed comprehensive audits to ensure there are no security problems, providing clients with added assurance.

For more information visit:

AUTHOR

Komentar

Posting Komentar